mass tax connect certificate of good standing

Please enable JavaScript to view the page content. Obtaining Good Standing Certificate in Massachusetts.

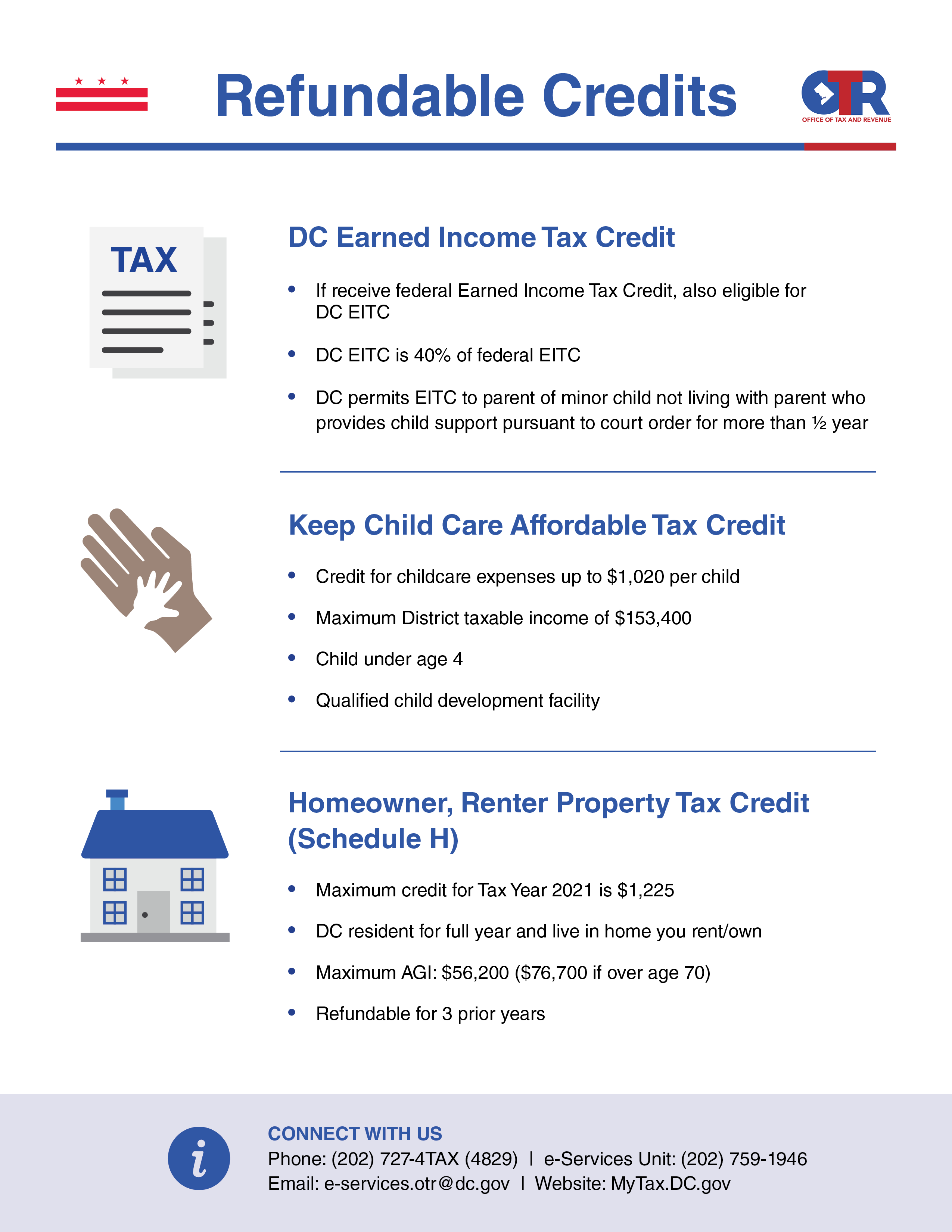

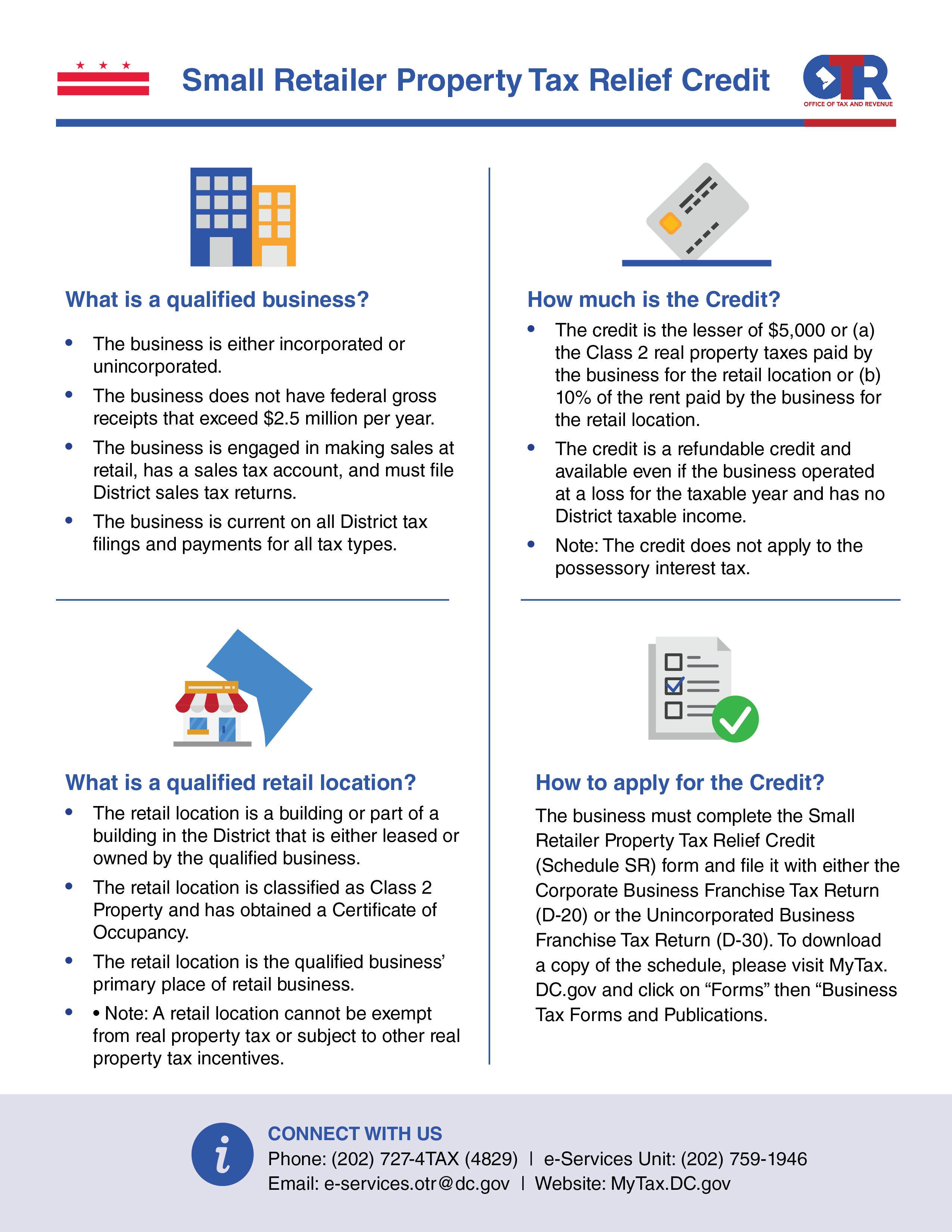

The Dc Office Of Tax Revenue Otr Mytaxdc Twitter

Get and Sign Massachusetts Certificate Tax Form.

. Enter the email you used in Step 3 along with the confirmation code from Step 5 and click on Search. You can order a certificate of good standing in the Commonwealth of Massachusetts by mail in person or online but we recommend online. For example the certification of your companys status as of January 1 2021 must be filed by April 1 2021.

You can acquire a certificate of good standing from your states organization filing company. Your support ID is. Ad Apply For Your Certificate of Good Standing.

To delete a payment i f the payment was made while logged into an MassTaxConnect account. A certificate of good standing or certificate of presence shows that a service has actually paid taxes filed required files and otherwise abided by policies in businesss state of formation. It will also be available to download from MTC_ Instructions to.

Select the Manage My Profile hyperlink in the top right section of the Home panel. Mass tax connect login certificate of good standing. The Annual Certifications of Entity Tax Status as of January 1 of each year must be filed on or before the following April 1.

These short video tutorials demonstrate how to navigate DORs MassTaxConnect. The Certificate of Good Standing will be mailed to the address provided below. 156D 1532 the Collections Bureau with the Operations Division issues the documents of goodtax standing described below.

Payments that have a status of In Process or Completed cannot be deleted. Navigate to the S earch S. Payments in MassTaxConnect can be deleted from the Submissions screen.

Employee Complaint Form Template Google Docs Word Apple Pages Template Net Employee Complaints Templates Word Doc Pin On Tax Dosti October 2018 Reporting Videos. If you need a new username. Make a voluntary disclosure of prior tax obligations.

File and pay salesuse tax on a motor vehicle or trailer File Form ST-7R File and pay salesuse tax on a boat recreation or snow vehicle File Form ST-6 or ST-6E Verify sales tax resale certificates. Order Your Massachusetts Certificate of Good Standing. You can acquire a certificate of great standing from your states company filing.

Corporations and other organizations often need proof that they are in good tax standing with the Commonwealth ie that all tax liabilities have been met. Normal processing takes up to 5 days plus additional time for mailing and costs 12. Your support ID is.

Mass tax connect certificate of good standing Saturday 26 February 2022 Edit. As authorized under GL. Most states want to see a certificate of good standing or its equivalent before allowing a company to do business in that state as a foreign entity process called foreign qualificationCompanies that intend to expand abroad might also need to obtain certificate of good standing and then certify it for foreign use either.

Complete in Just 3 Steps. Once your business remains compliant with the state you can request a Massachusetts certificate of good standing from the Department of Revenue. Massachusetts Certificate Tax Form.

Home connect of standing tax. For further information call 617 887-6367. Spanish subtitles are available for select videos noted with an asterisk.

When completing this form be sure to print legibly. MassTaxConnect Video Tutorials. Prove That Your Company Has Met All State Requirements And Is Authorized To Do Business.

Mass tax connect certificate of good standing. The payments must have a status of Submitted to be deleted. Online processing costs 15 and the certificate will be emailed to you the same day.

Return to Mass Tax Connect and chose Find a request under Quick Links. Name of organization Trade name or DBA Federal ID or Social Security number. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

How do I delete a payment. Please enable JavaScript to view the page content. Select the Delete My Profile hyperlink in the Access section to cancel your current username.

This can be done online by mail or by fax. Appeal Motor Vehicle Sales Tax. View Sample of Certificate of Good Standing Please submit the certificate to ETPLMassMailStateMAUS.

Expedited service is available for. Shortly after April 1 2021 the 2021 Corporations Book will be released online to assist local boards of. 138 64 and GL.

A Certificate of Good Standing from DOR is required for Training Providers to meet DOR compliance. Certificate Of Good Standing Fundamentals Explained Mass Tax Connect Certificate Of Good Standing Table of ContentsIllinois Certificate Of Good Standing Fundamentals ExplainedWhat Does Certificate Of Good Standing Massachusetts DoThe Definitive Guide to Certificate Of Good Standing New YorkThe Main Principles Of Certificate Of Good Standing Texas What Is A. They are designed for both beginners and experienced users.

A certificate of great standing or certificate of presence reveals that a company has actually paid taxes submitted needed documents and otherwise adhered to regulations in businesss state of formation. Request a Certificate of Good Standing. The filing fee is 125 for corporations and 500 for LLCs.

Log in to MassTaxConnect. Revenue PO Box 7066 Boston MA 02204 or fax to 617 887-6262. You can then reregister creating a new username to gain access to your tax accounts.

62C 51 52 GL.

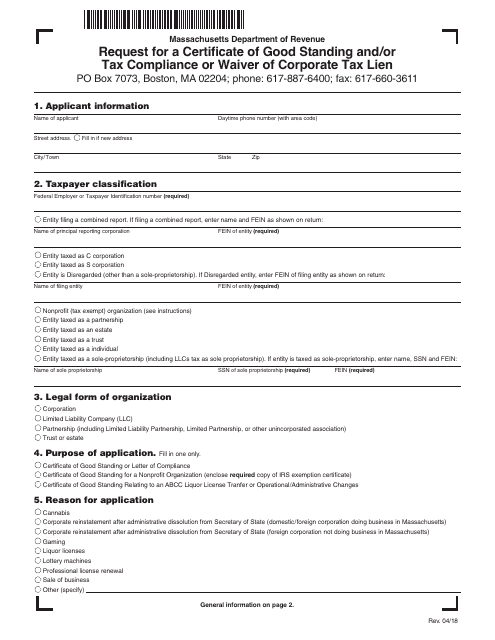

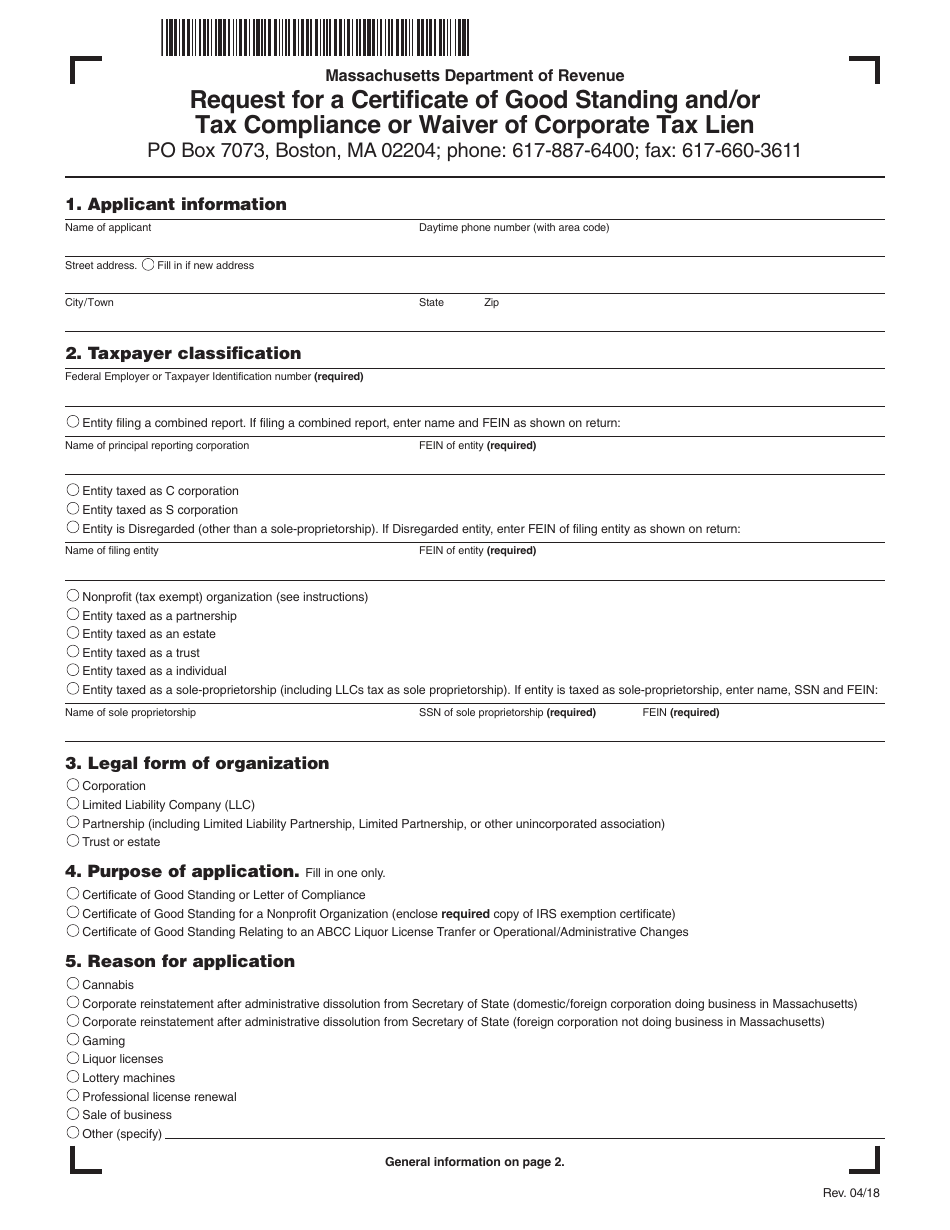

Massachusetts Request For A Certificate Of Good Standing And Or Tax Compliance Or Waiver Of Corporate Tax Lien Download Printable Pdf Templateroller

Believe It Or Not Tax Burden In Massachusetts Is Average Not Taxachusetts Opendor

Believe It Or Not Tax Burden In Massachusetts Is Average Not Taxachusetts Opendor

How To Log In To Masstaxconnect For The First Time Youtube

Massachusetts Sales Tax Small Business Guide Truic

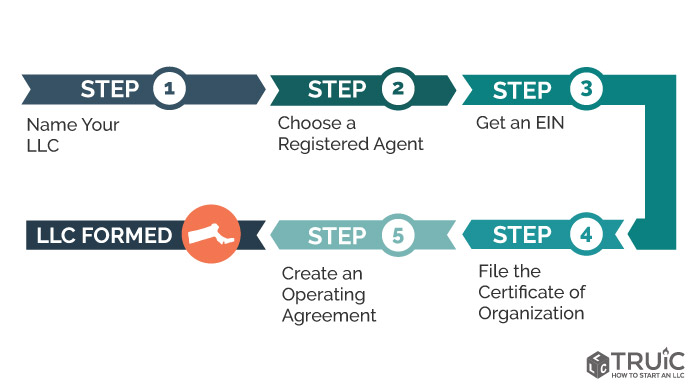

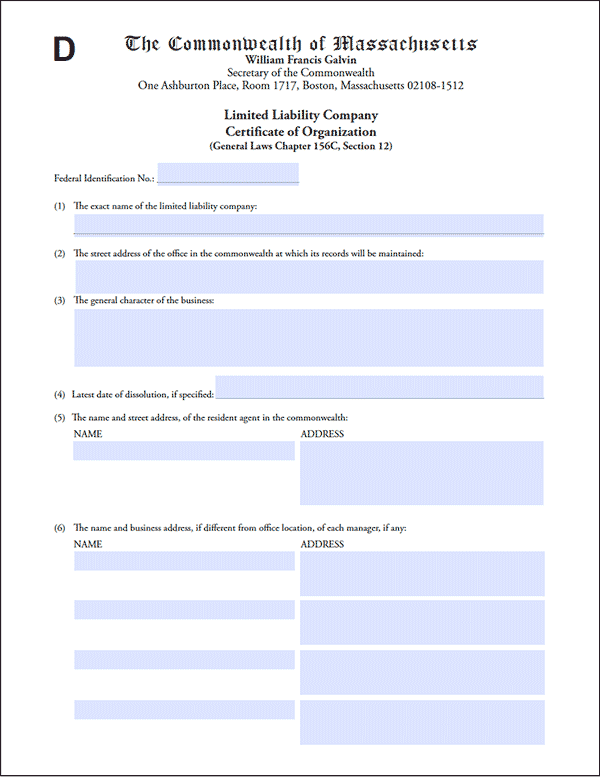

Llc Massachusetts How To Start An Llc In Massachusetts Truic

The Dc Office Of Tax Revenue Otr Mytaxdc Twitter

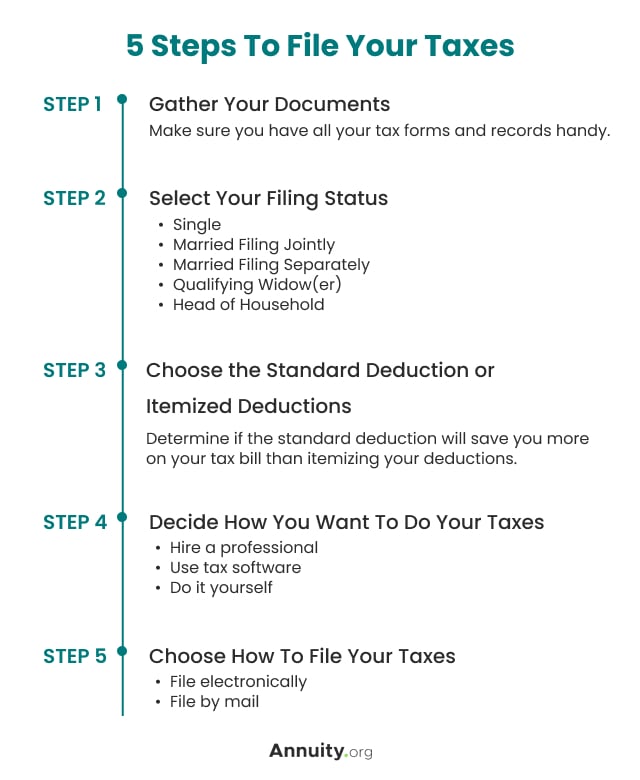

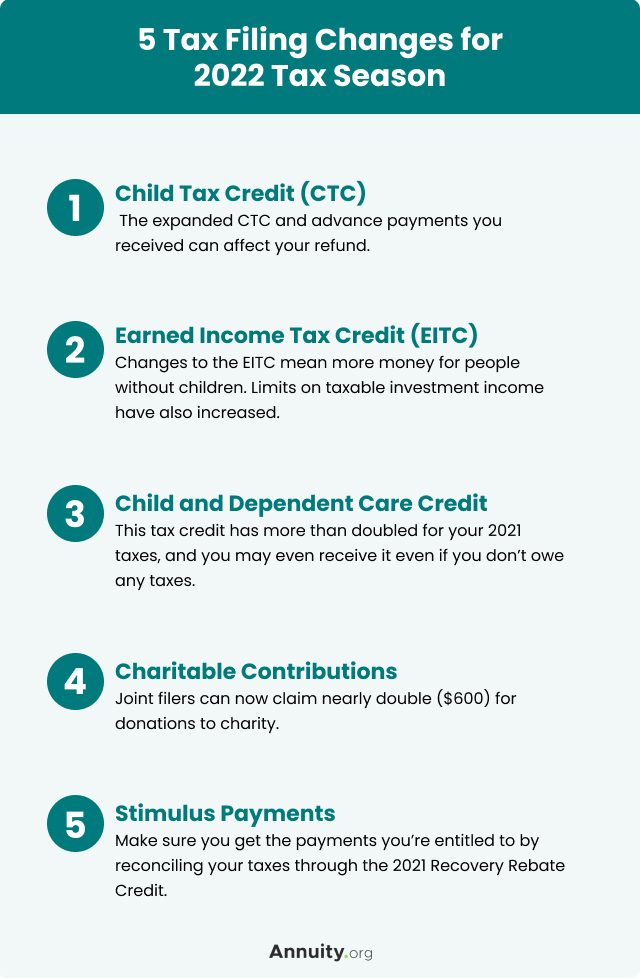

2022 Filing Taxes Guide Everything You Need To Know

Llc Massachusetts How To Start An Llc In Massachusetts Truic

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

Believe It Or Not Tax Burden In Massachusetts Is Average Not Taxachusetts Opendor

Massachusetts Request For A Certificate Of Good Standing And Or Tax Compliance Or Waiver Of Corporate Tax Lien Download Printable Pdf Templateroller

2022 Filing Taxes Guide Everything You Need To Know

Sales And Use Tax For Businesses Mass Gov

Massachusetts Request For A Certificate Of Good Standing And Or Tax Compliance Or Waiver Of Corporate Tax Lien Download Printable Pdf Templateroller